Global Feminine Hygiene

Cotton delivers quality and comfort.

U.K.

69%

ITALY

86%

GERMANY

82%

FRANCE

77%

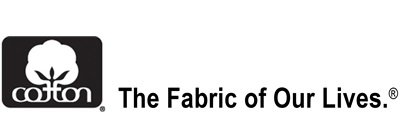

Brand

LOYALT Y

8 IN 10 WOMEN say they generally stay with the same brands of feminine

hygiene products.

The top 3 tampon brands account for

4 in 5 purchases made by women in the

following countries.

The top 3 pad brands account for 4 in 5

purchases in the US, Europe, and Mexico

and the majority in China.

The top 3 brands of pantiliners ac-

count for half or more of the purchas-

es made by women in the following

countries.

Regardless of demographics or market

studied, feminine hygiene products must

prevent leaks, be absorbent, keep skin

dry, and be functional (such as sticking

to underwear, not being visible, not

being bulky, etc.) AND be comfortable,

soft, and hypoallergenic in order to be

considered by women globally.

Purified cotton is highly absorbent:

24 grams water/gram of fiber

Cotton is naturally hypoallergenic

Cotton is strong: Wet strength is 3.7

times stronger than pulp

Brand Loyalty is very strong across markets, but opportunities

exist for new concepts in product development, channels of

distribution and target marketing.

MEXICO

89%

U.S.

84%

U.K.

80%

ITALY

86%

U.S.

84%

GERMANY

79%

U.K.

85%

MEXICO

85%

FRANCE

80%

FRANCE

67%

CHINA

58%

ITALY

90%

MEXICO

78%

GERMANY

80%

CHINA

50%

U.S.

77%

Performance

IS IMPORTANT

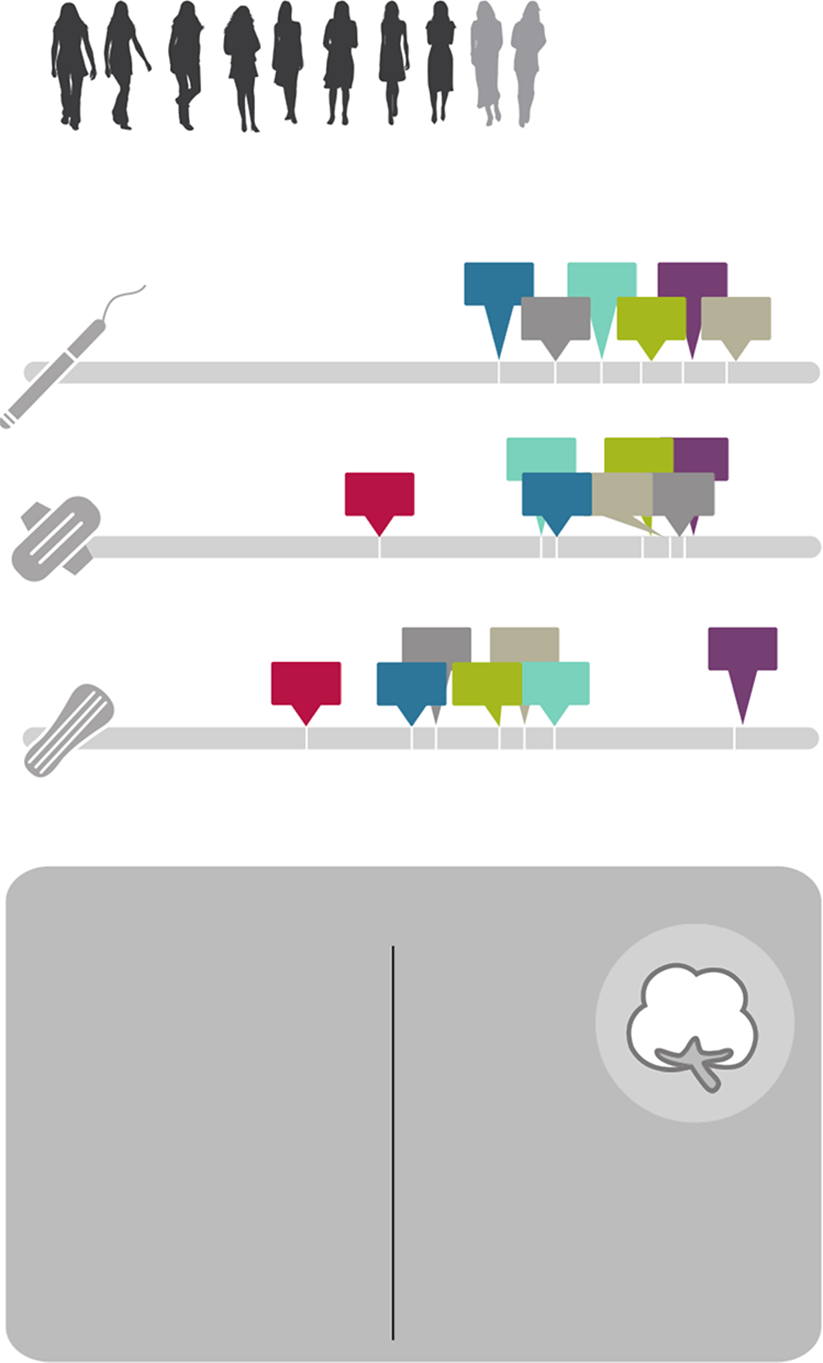

Social

Combo

PRODUCTS

Nearly half of tampon users in these countries say they always or usually use a pantiliner

when using a tampon.

About a third of tampon users always or usually use a pad when using a tampon.

About 1 in 5 women say they follow feminine hy-

giene brands on social media sites.

In the US, women mainly follow these social media

sites for coupons and promotions.

Opportunities exist to take advantage of this trend by creating mixed product boxes or

offering promotions around buying two different types of feminine hygiene products at

the same time. Tampon brands without complementary pad/liner products may want to

consider line extensions.

Reaching out to consumers about your brand, new product launches, etc. through social

media is essential in retailing today across categories. There is a major untapped opportu-

nity for feminine hygiene brands to utilize social media to develop a stronger relationship

with their customers beyond point of sale and entice new customers to try their products.

Social Media Marketing is greatly underutilized

as a customer engagement tool.

A sizeable share of tampon users

are combining products – offering

opportunities for mixed product

packages, new promotions,

and/or consumer education.

51%

ITALY

37%

49%

GERMANY

31%

47%

U.S.

31%

44%

FRANCE

35%

39%

MEXICO

33%

36%

U.K.

37%

EUROPE

U.S.

MEXICO

Pad

Tampon

Pad

Tampon

Pad

Tampon

Pad

Tampon

Pad

Tampon

Pad

Tampon

Liner

Tampon

Liner

Tampon

Liner

Tampon

Liner

Tampon

Liner

Tampon

Liner

Tampon

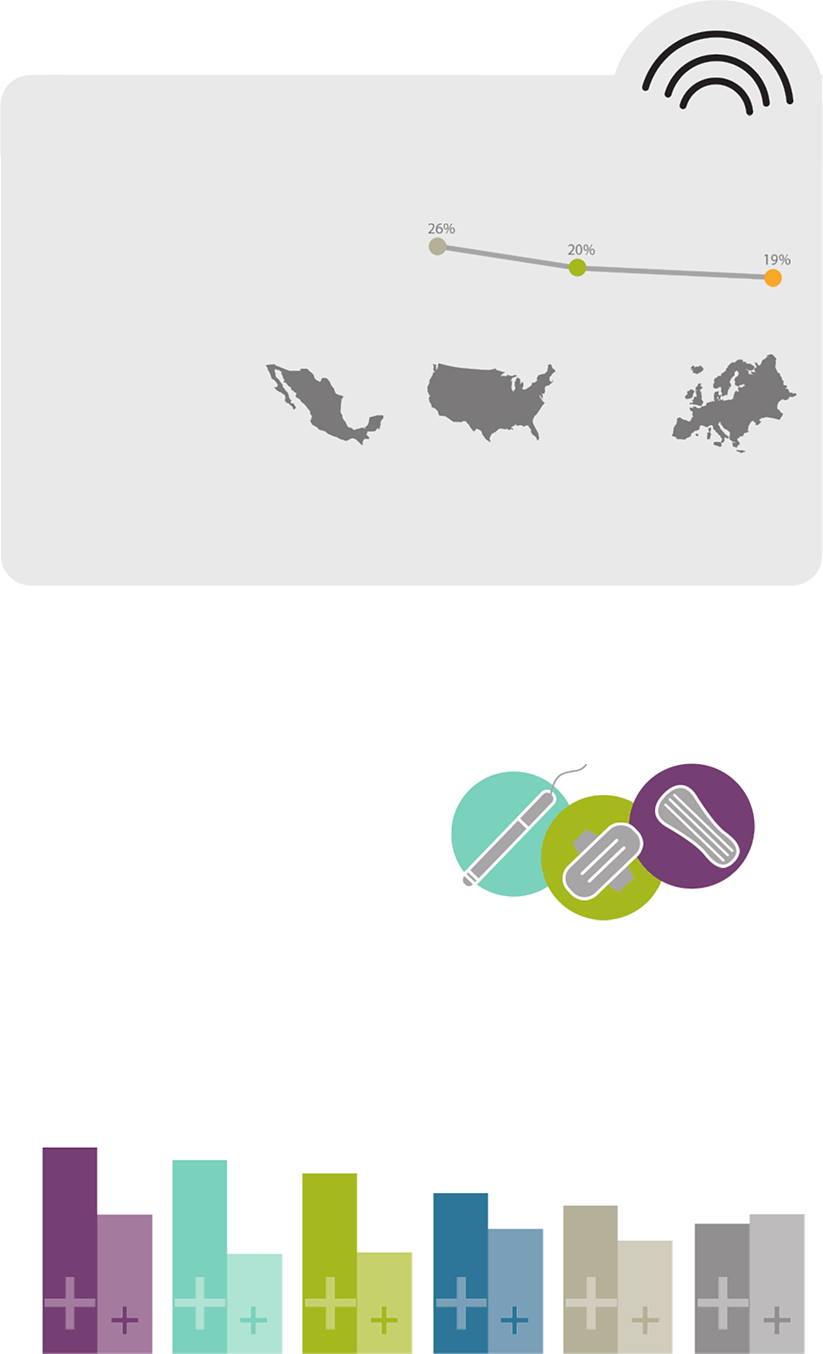

Young

CONSUMERS

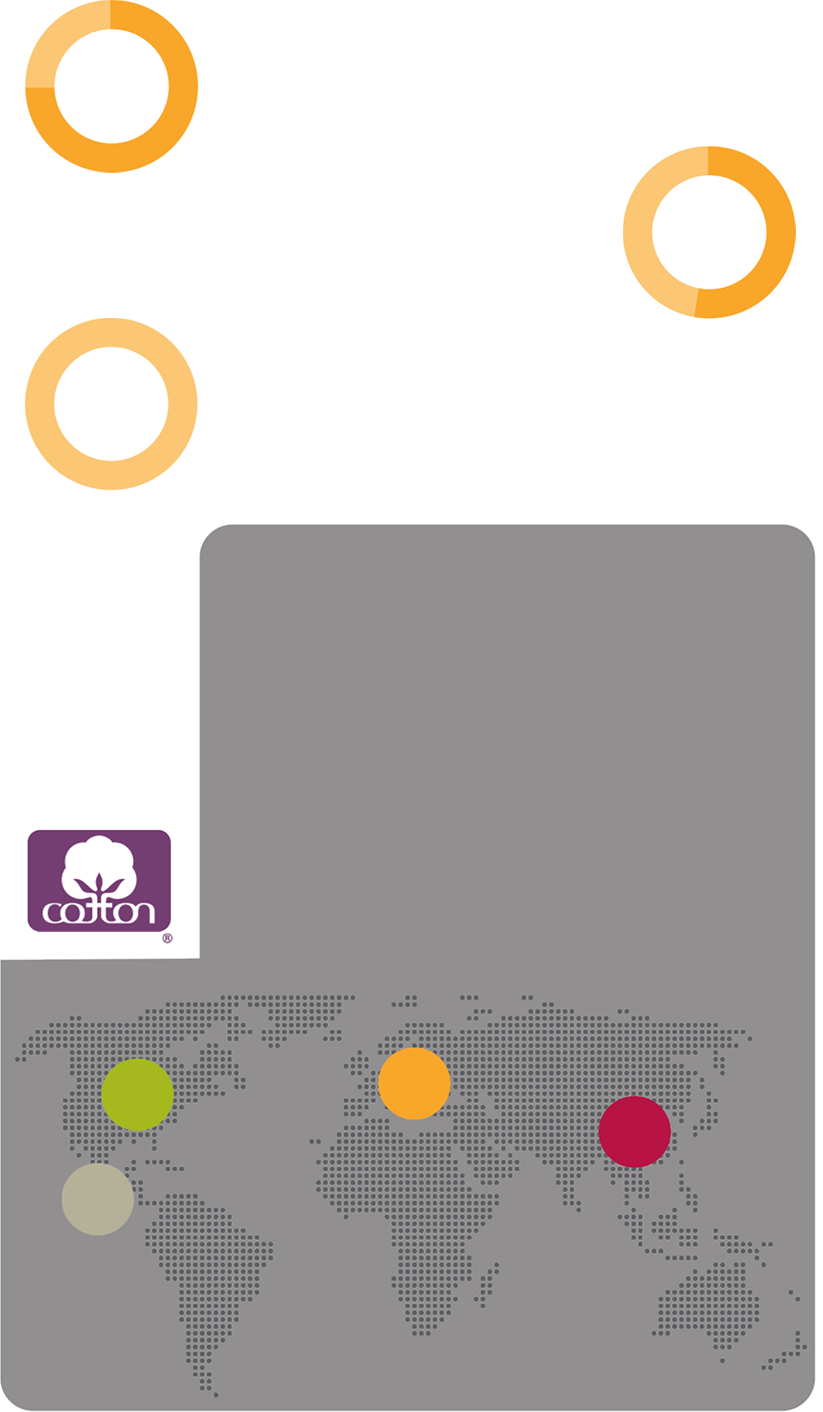

Women see cotton as better suited than manmade fibers in meeting

their primary feminine hygiene needs of performance and comfort.

Most women are willing to switch brands and/or pay a slightly higher

price to purchase cotton feminine hygiene products.

The majority of women say they are willing to switch brands to purchase

cotton feminine hygiene products if they knew those products were

more comfortable, hypoallergenic, and sustainable.

The majority of women say they prefer their feminine

hygiene products to be made from cotton.

3 in 4 European girls ages 10-17 say they are very interested in

feminine hygiene products that are made from natural or sustain-

able materials, significantly higher than the overall market.

More sustainable offerings,

product subscriptions, and en-

gagement through social media

will be essential to appeal to to-

morrow’s feminine hygiene

shoppers.

75

%

A third of European girls ages 10-17 say they follow feminine hy-

giene brands on social media, again higher than the overall

market. Using social media as a tool to educate, entertain, and

build a relationship with young women is essential for any estab-

lished brand or new entrants.

34

%

Half of European girls ages 10-17 say they would be interested in

a subscription service that delivers feminine hygiene products to

their door once per month, a Millennial characteristic.

51

%

Cotton

DIFFERENCE

THE

83

%

MEXICO

62

%

U.S.

58

%

EUROPE

75

%

CHINA

Cotton Incorporated's 2015 Chinese Feminine Hygiene Study - surveyed 500 feminine hygiene product users ages 18-45 across 16 citities covering all four major

tiers and regions in China. Respondents were representative of the Chinese population.

Cotton Incorporated's 2015 U.S. Feminine Hygiene Study - surveyed 1,000 feminine hygiene product users ages 18-50. Respondents were representative of the U.S.

population.

Cotton Incorporated's 2015 European & mexican Feminine Hygiene Study - surveyed 500 feminine hygiene product users ages 10-50 in the UK, Germany, France,

Italy, and Mexico. Respondents were representative of their respective populations.