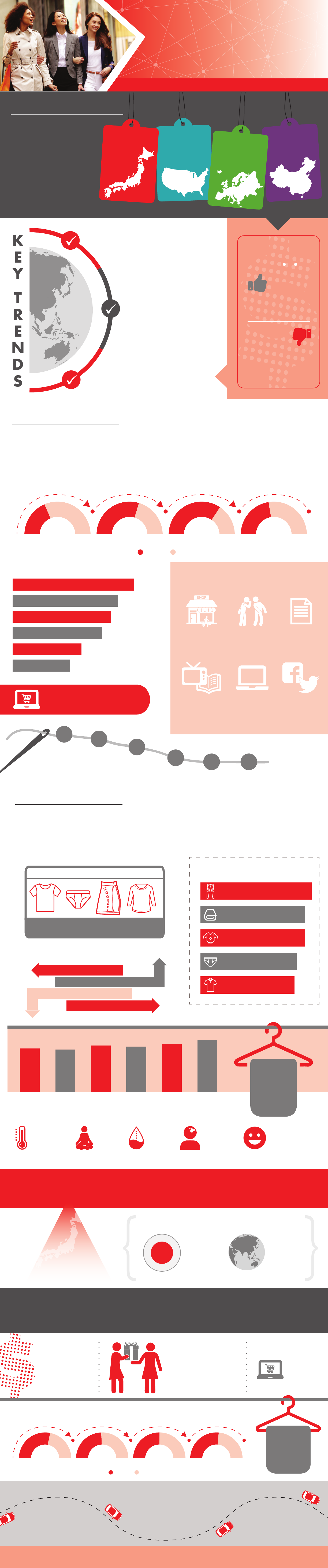

Spotlight on Demographics:

Target middle-aged Japanese

women with in-store clothing inspiration

as they shop for children, significant

others, and themselves.

GLOBAL CONSUMER

INSIGHTS

GLOBAL LIFESTYLE MONITOR: JAPAN

Japanese consumers spent a

robust $89.6 billion on

clothing in 2017. With a

declining population, this

number is expected to shrink

8% by 2030. Brands &

retailers can gain an edge in

this competitive market by

understanding their needs

and shopping habits.

APPAREL SPENDING

What They Shop: Seize

opportunities to meet consumer

needs for price-conscious,

comfortable clothing without

sacrificing quality.

FINANCIAL

OUTLOOK

36% 56%

OPTIMISTIC

How They Shop: Help consumers make

informed purchases with online product

information and expert in-store advice for

a seamless shopping experience.

US

$338.9

+56% growth

CHINA

$277.2

+193% growth

EU

$374.5

+52% growth

JAPAN

$89.6

¹

-8% growth

PESSIMISTIC

Japan Global

28% 11 %

Japan Global

*”Neither Optimistic/Pessimistic”

not shown

HOW THEY SHOP

Japan is a highly connected country, with 90% of the population using the internet weekly and more

mobile phone accounts than people (130 accounts per 100 individuals)

²

. They use this connectivity to

research clothing online before going to physical stores to make purchases, spending more of their

shopping journey online than consumers globally. Reach these consumers with an active online presence

combined with engaging, informative in-store experiences.

36% 59% 69% 45%

clothing research pre-purchase questions purchase repeat purchase

in-store online

SHOPPING JOURNEY

RETAIL STORES SHOPPED FOR CLOTHING

DISCOUNT 53%

46%

43%

39%

30%

25%

SPECIALTY

ONLINE ONLY

CHAIN

FACTORY

DEPARTMENT

41%

40%

34%

28%

27% 27%

APPAREL SHOPPING HABITS

Buying on Impulse

2008

2010

2012

2 014

2016 2018

SOURCES FOR

CLOTHING IDEAS

Window

Shopping

46%

33%

Shop online at

least 1 time a month.

Other

People

43%

Store

Publications

32%

Traditional

Media

29%

Brand & Retailer

Digital Resources

29%

Social

Media

18%

Consumers who prefer in-store shopping

BABYWEAR

72%

WHAT THEY SHOP

As Japanese consumers’ personal financial outlook has steadily risen from 13% optimism in 2010 to 36%

in 2018, they are more likely to choose quality over price when purchasing clothing. While still

price-conscious, consumers look for comfort, color, and fit when shopping for clothing and are intrigued

by clothing with performance features to help monitor and address physical processes such as

perspiration and hydration.

TOP ITEMS OWNED

COTTON PREFERRED FIBER

PAY MORE FOR BETTER QUALITY

PERFORMANCE APPAREL

UnderwearT-shirts Skirts Casual Shirts

1011 7 6

PRIMARY PURCHASE DRIVERS

PRICE 70%

COMFORT 64%

COLOR 64%

FIT 61%

2008

45%

2010

44%

2 012

48%

2014

47%

2016

50%

2018

54%

Likely to Purchase

HOME TEXTILES

72%

40% 39% 33% 27%

Regulate Body

Temperature

Relieve

Stress

Monitor

Hydration

Monitor

Perspiration

25%

Manage

Mood/Emotions

71%

prefer cotton or

cotton blends

for their

most-worn

clothing

INTIMATES

68%

PANTS

76%

Average Number

SHIRTS

67%

Consumers would like to know prior to purchase

79%

prefer cotton or

cotton blends for

their most-worn

clothing

JAPAN’S MIDDLE-AGED

WOMEN CONSUMERS

SPOT

LIGHT

With the second highest median age in the world, companies in Japan increasingly look to target older

consumers, many of whom are women. Nearly half of Japanese women 45+ are optimistic about their

personal financial circumstances, and 54% regularly purchase clothes for others. Reach these consumers

with in-store clothing inspiration and details about items’ quality, fiber content, and laundering.

Source: Cotton Council International and Cotton Incorporated’s Global Lifestyle Monitor Survey, a biennial consumer research study. In the 2018

survey approximately 10,000 consumers (i.e. 1,000 consumers in 10 countries) were surveyed. External Source: ¹Euromonitor International ²World

Bank ³CIA World Factbook

47.3 30.4

³

MEDIAN AGE

FINANCIAL

OUTLOOK

43%

OPTIMISTIC

SHOP FOR OTHERS SHOP ONLINE

SHOPPING JOURNEY

PURCHASE DRIVERS

47% 56% 72% 50%

clothing research pre-purchase questions purchase repeat purchase

in-store online

Japan Globally

54% 33%

All

Consumers

25%

at least

one time

a month

Women

44-54

QUALITY

60%

55%

Women 45-54

All Consumers

FIBER CONTENT

48%

39%

Women 45-54

All Consumers

LAUNDERING

45%

32%

Women 45-54

All Consumers

Percentage of middle-aged women who prefer in-store shopping